Rental Property Cash Flow Statement: Definition, Use, Formula and Example

The rental property cash flow is used to track and analyse data, as well as to record and track data, in the rental business’s transactions. These transactions, as well as the money that has been made from sales and profits, are called purchases and payments. For rental property, it is very important to have a good cash flow statement because it is used to figure out how the business is doing right now. Most people who are just starting out in the rental property business fail because they don't know how important it is to have a cash flow statement for their rental property and can’t make one. One example of a cash flow statement for a rental property is the total amount of rent that the renters paid for the whole year that they lived there. When the whole amount is subtracted from the total cost, the amount of money left over is called the profit.

What is a Rental Property Cash Flow Statement?

The rental property cash flow statement is the overall data record and analysis of the property’s expenses and generated income. A rental property can be maintained and properly managed through the help of rental property cash flow statements. In the rental property business, there are three data to be recorded, capital, income, and expenses. The source of income is taken from the rent which will be deducted from the total expenses, and it will be visualized if there is revenue or loss because it will be compared to the capital’s amount. Hence, rental property cash flow is very important to keep the business organized.

What is the use of Rental Property Cash Flow Statement?

The rental property cash flow statement runs the rental property business. It serves as the fuel that its existence matters if the owners want their business to succeed.

Listed below are the uses of rental property cash flow statements.

- Cash Flow Tracking: The use of rental property cash flow statements is to keep track and record how the money moves inside and outside the business. The rental property business has a high chance of failure if it doesn’t have a proper cash flow statement, as it will not be able to trace the inflows and outflows of money.

- Capital and Expenses Calculation: Rental Property Cash Flow Statement calculates how much capital has been used for expenses and how much return has been received.

- Income Computation: After the calculation, it will then subtract the gathered data to show how much money has been earned for that particular point in time.

- Attracts Investors: Rental property cash flow statement is one of the factors that investors consider when looking for a rental property business that they will be investing in. When a rental property is good, then it is expected that a lot of investors will come.

What does a Rental Property Cash Flow Statement looks like?

What is the formula for Rental Property Cash Flow?

Rental properties must be regulated by rental property cash flow. It will help the owners have a better vision of the current status of their businesses.

Listed below is the formula for rental property cash flow.

Monthly rent x number of units x 12 months - (annual payment for the property + expenses for maintenance, repair, taxes, etc.) - average annual vacancy

How to calculate rental property cash flow?

To calculate the rental property cash flow, the given value must be implemented in the given formula.

$500 x 6 units x 12 months - ($5,000 + $3,500) - 10%

$36,000 - $8500 - 10% = $27,500 -10%

$27,500 x 10% = $2,750

$27,500 - $2,750 = $24,750

What is the best cash flow rental calculator?

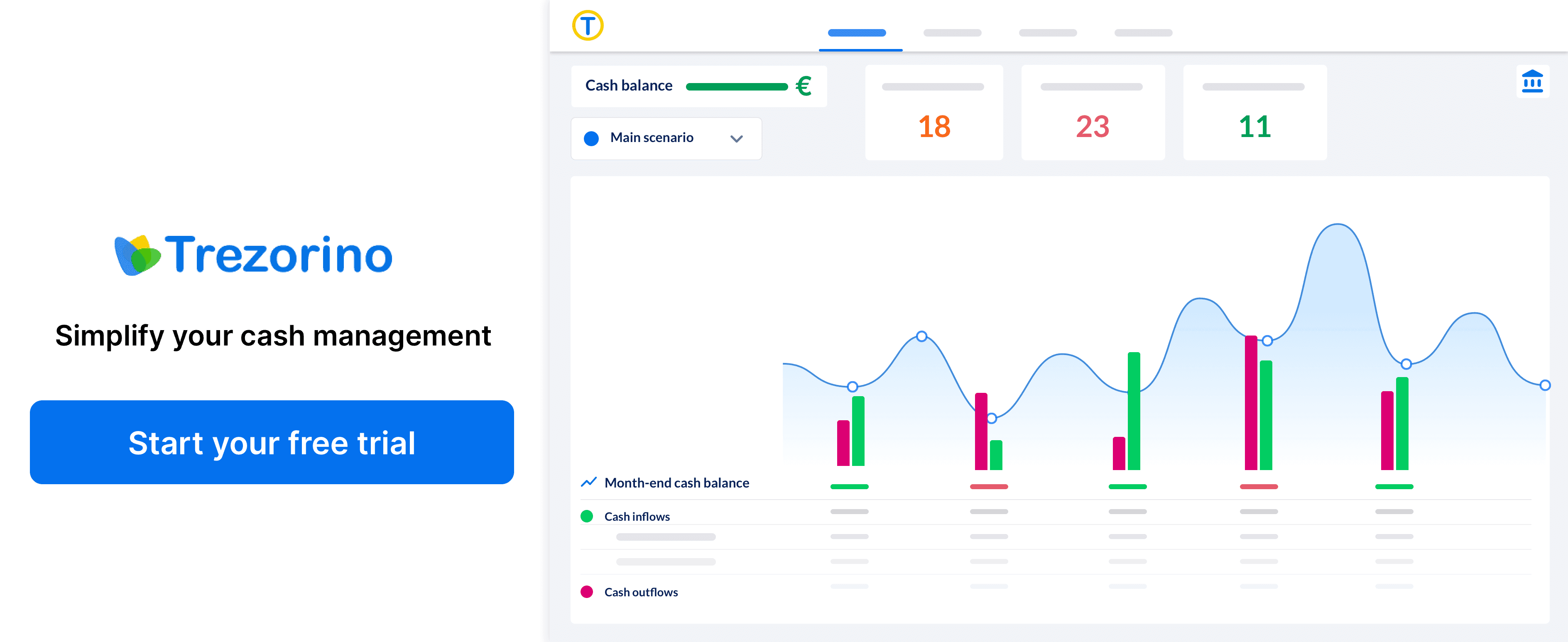

The best cash flow rental calculator is Trezorino. It is a great cash flow tracker that allows users to calculate their cash flow in a more simplistic and comprehensible way. It is considered one of the best as it focuses more on the accurate data visualization of the cash flow, which helps business owners to monitor it easily. In addition to that, the transactions of the businesses either made from bank accounts or business applications are all tracked and recorded. Lastly, the software paves a way for more immediate and efficient solutions.

What is a good Cash Flow on Rental Property?

A good cash flow on rental property lies in three factors, location, property type and price, and rental strategy. The location of rental property must not be located in a place where taxes, permits, and other government charges are high. Even a slight amount of increase in the percentage of the charges will drastically affect the total cash flow of the rental property. In addition, the property type and price is also a part of the category. A rental property that can be occupied by different groups of tenants will most likely generate more income than a large house being occupied by a single family. The prices of each property also impact the cash flow. For instance, the large house’s monthly rent is $1500, on the other hand, the rental property with 10 units charges $180 per unit monthly. The latter generates more income. Lastly, the strategy of the landlord or investors plays a major role in having a good cash flow. The ability to market the rental property very well attracts a lot of tenants, which will boost the revenue of the said business. An investor who doesn’t know how to calculate a rental property cash flow statement must not immediately dive into the rental business. Before investing anything in the rental business, it is very important first to know what good cash flow is and how to calculate it.

How much is Cash Flow Good For Rental Property?

Good cash flow is usually based on return on investment (ROI). An ROI of 8% is good, but it becomes better as the percentage goes up. However, what constitutes a good cash flow varies among different investments and investors. Some rental property investors search for a minimum return on investment (ROI) such as 6% or a maximum of 12%. Meanwhile, others search for a property that provides a substantial net cash flow to satisfy desired cash-on-cash returns. ROI shows how well the investment capital is doing, which is one of the factors to attract investors.

Can I make a Rental Property Cash Flow Statement in Excel?

Yes, the owner of a rental property can make a rental property cash flow in Excel. Microsoft Excel is designed to be a platform for the analysis of data, especially business data. Thus, a rental property cash flow is just a piece of cake for Excel. Just use the proper formula and encode the correct data, and then it is good to go.

Can I use Excel as a Property Cash Flow Calculator?

Yes, rental property cash flow can be calculated via Microsoft Excel. It consists of numerous significant formulas that can be useful to compute rental property cash flow. The cash flow for rental properties does not demand a complex set of operations, so the software can handle it. To conclude, Excel can be utilized as a calculator.

Is Rental Property Cash Flow can be considered a cash flow investing activity?

Yes, rental property cash flow can be considered as one of the cash flow investing activities, specifically, under property expenditures. Rental property cash flow refers to the expenses used to acquire properties and maintain them for the tenants to occupy them. On the other hand, property expenditures under the cash flow investing activity, are all about the resources used for maintenance such as repair and taxes to manage a real property well. Thus, both are having the same definition, which makes rental property cash flow one of the cash flow investing activities.